Online Identity Verification in Auditing and Accounting Firms

Auditing and accounting global leaders are responsible for having the most significant number of hirings each year. According to Statista, the Big Four Auditing and accounting firms employed a total of 1,148,505 employees in the year 2020. In addition, they generate more than significant revenues and onboard diversified clients from all over the world.

Unfortunately, these global leaders are more prone to the risk of frauds, scams, hacks, identity thefts, embezzlement, and deceitful acts than other businesses can ever be. Identity verification services are ideal for keeping ID theft frauds and scams away from accounting and auditing firms.

What is Identity verification?

Identity verification is verifying the true identity of a client or an individual through face, documents, addresses, phone, and by running background checks.

There are two types of identity verification

- Manual identity verification

- Online identity verification

What is manual identity verification?

Running manual identity verification checks involves individuals checking the documents. However, there are numerous drawbacks to manual checks such as human errors, lack of updated knowledge of policies, and lack of skimming the documents according to guidelines.

How Does Online Identity Verification work?

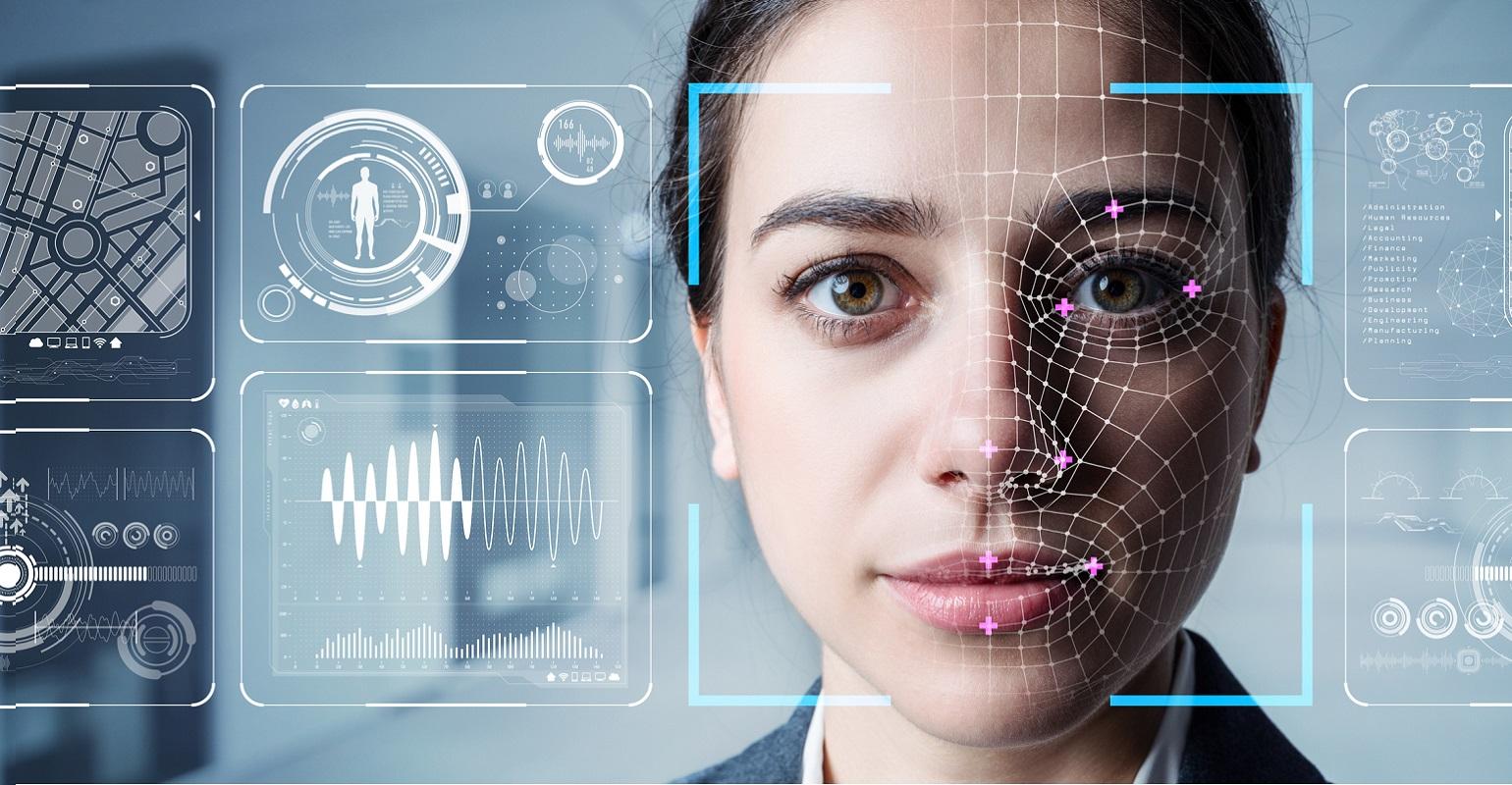

Online Identity verification is performed through face verifications, document verification, consent verification, address verification, and background checks but in a matter of seconds.

Facial Recognition

Some of the face verifications techniques are liveness detection, texture verification, 3D depth analysis, and skin texture analysis.

Document Verification

The authenticity of the documents is checked by verifying the holograms, rainbow marks, and micro prints.

Address Verification

For address verifications, telephone or electricity bills are used, but they should be a maximum of 3 months old.

But how can online Identity verification benefit auditing and accounting firms?

Let’s dive in to explore!

Reducing Identity theft

Businesses and companies are issuing Personal Identity Verification (PIV) cards to their employees to give them access to their offices. The same goes for Auditing firms, but PIV cards are not always retrieved from contractors and employees who have been terminated.

Renewal of cards after accurate and updated identity verifications of employees and contractors ensures a risk-free environment and cuts down identity thefts.

KYC and AML compliance

Every year, financial institutions have to pay hefty fines, and the usual culprits of these fines are related to improper screening of customers and clients and lack of proper AML compliance. This leads to reputational damage as well as significant financial losses.

To avoid penalties, financial institutions such as the Big Four Auditing Firms can take identity verification services that are Pro in complying with KYC and AML laws. In addition, AML and KYC screenings allow customers and business screening within seconds, reducing human errors.

Improves business reputation

Businesses hold their reputations close to their heart, and this is why they invest their all into building a reputation worth saving. In a world full of frauds, scams, and breeches, customers are attracted to other businesses that show interest in building trust. Trust between clients and businesses can be built through identification verification.

Reduce Operational Costs

Businesses these days are opting for sustainable developments that encourage effective cost management. Digital identity verification systems are equipped with artificial intelligence, human intelligence, and facial recognition techniques. These techniques ensure that customer identity verifications are performed within seconds.

Additionally, when digital identity verifications are performed, the cost of manual verifications lowers when onboarding new clients and managing old clients and Ultimate Beneficial Owners (UBO).

Decreasing Human Errors

90% of workplace accidents have been caused by human errors. Human errors can cause businesses bankruptcy, loss of valuable time and contribute to low workplace productivity. Online identity verifications can be the best approach to ensure minimal human errors.

Avoiding hackers or scammers

Auditing and accounting firms can mistakenly give a way to hackers or scammers without the use of identity verifications. For instance, hackers can hack systems of accountants and use privileged information to either blackmail the client or destroy the company’s reputation.

According to The Guardian, Deloitte was under hot water when a hacker shared private emails of six partnering companies in March 2017. In another famous attack, sensitive information of the CEO of FACC was used, and fake letters were issued to transfer funds to hackers’ accounts.

These breaches can be avoided by creating awareness and running identity verification checks.

Ultimately, to sum it all, businesses can save themselves from the hassle of identity verification and easily avoid hefty fines. In opting for identity verification, businesses can direct their energy into providing their clients the best services rather than spoiling their enthusiasm.